Ledger Cathay Capital Announces €100M Web3 Fund

Ledger and Cathay Innovation launch early-stage venture capital fund to onboard the next billion users in Web3

Ledger has joined forces with Cathay Innovation to launch a €100M ($110M) early-stage venture capital fund with the mission of onboarding the next billion users into Web3.

Led by Cathay Innovation’s Denis Barrier and Ledger CEO Pascal Gauthier and Michael Louzado, VP of Strategy, M&A & Ventures, the fund will invest globally in Seed to Series A companies focused on emerging DeFi, security, infrastructure, digital ownership technologies, protocols and more.

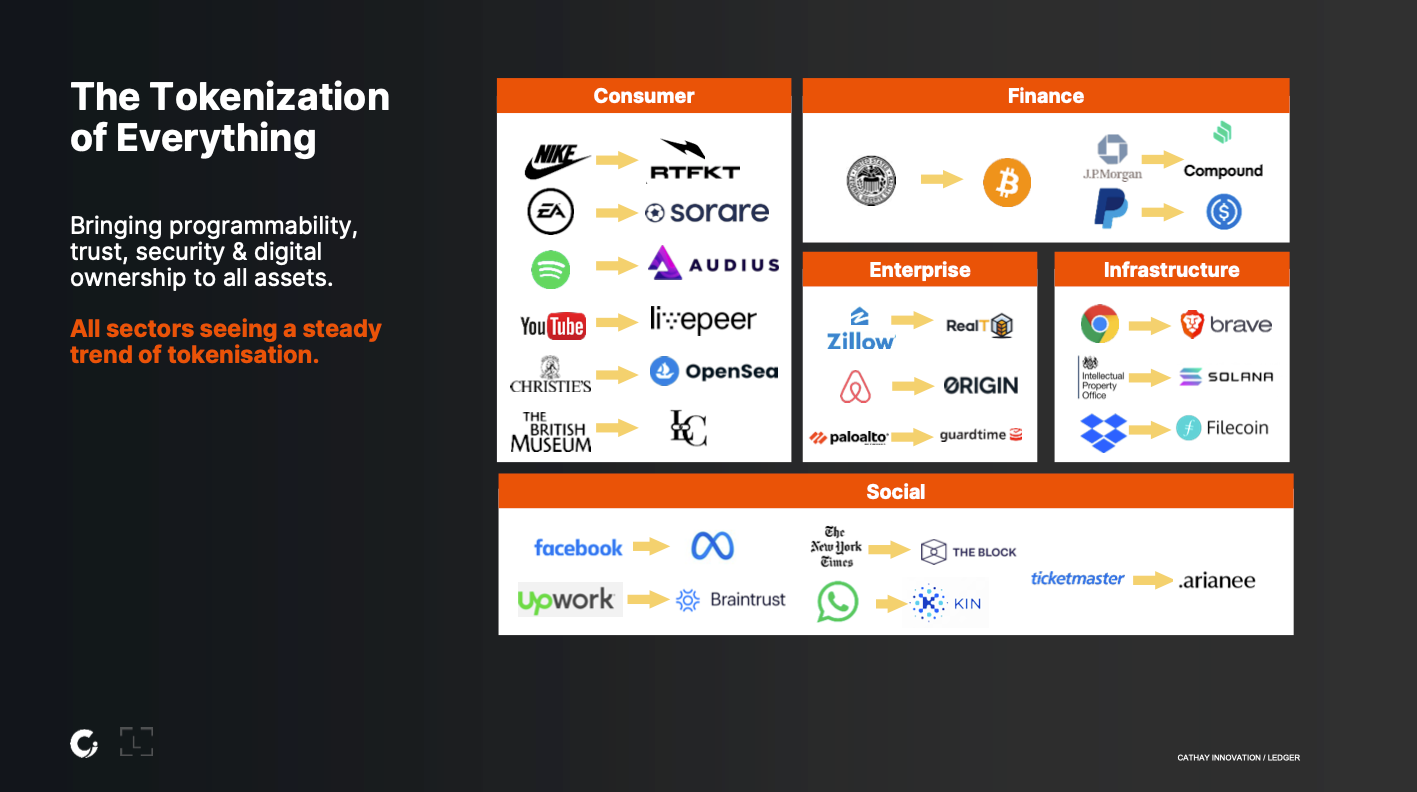

As the creator economy further embraces the technologies and tools of Web3, more and more of the world’s intellectual property and financial assets will be tokenized. According to the announcement,

By 2027, 10% of the world’s GDP is expected to be stored on public blockchain technology, representing a market of $13.4 trillion US dollars.

For the last 7 years, the crypto adoption rate has followed the same pattern as the internet in the 1990’s. If this trend holds, reports predict that there will be between 1 and 1.6 billion users by 2027.

Ledger, one of France’s most globally recognizable unicorn companies, is an early pioneer and leader in crypto custody solutions, securing an estimated 20% of all cryptoassets world-wide. Cathay Innovation, a well-known venture capital fund historically bridging France and Asia, is a part of Cathay Capital’s global investment platform with over $4B in assets under management across 16 funds and 220 investments. With all of that French DNA, it is no surprise that France’s public investment bank, Bpifrance, is one of the new fund’s backers. Cathay Innovation previously invested in Ledger’s $75M Series B and $380M Series C fundraising rounds.

Ledger Cathay Capital looks to invest in between 20-25 seed to Series A-stage companies over the next two to three years, with check sizes ranging between €500k and €4M.

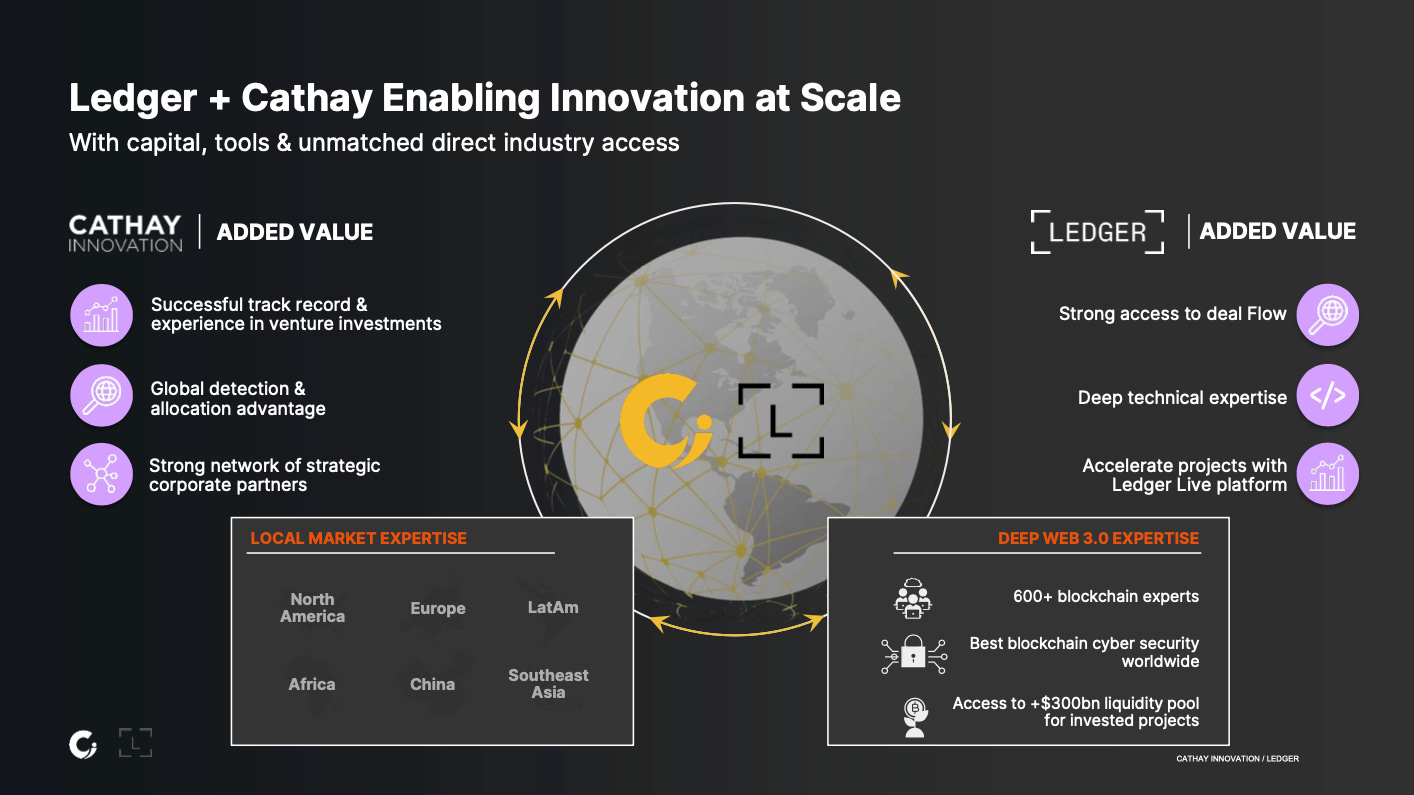

Working together to bring capital, tools, and unmatched direct industry access, Cathy Innovation has a:

successful track record and experience in venture capital investments,

global detection and allocation advantage,

strong network of strategic corporate partners,

while Ledger provides:

strong access to web3 startup dealflow,

deep technical expertise with over 600 employees and blockchain experts with over 70% of resources dedicated to research and development,

best-in-class blockchain cybersecurity,

a built-in accelerator through their hardware wallets’ Ledger Live platform.

access to an over $300B liquidity pool for invested projects.

Ledger Cathay Capital will have offices in San Francisco, New York, Paris, and Singapore.

Source: https://www.ledger.com/expanding-the-web3-borders-with-our-new-e100m-fund-ledger-cathay-capital